See This Report about Summitpath Llp

See This Report about Summitpath Llp

Blog Article

The Only Guide to Summitpath Llp

Table of ContentsThe Basic Principles Of Summitpath Llp Rumored Buzz on Summitpath LlpThe smart Trick of Summitpath Llp That Nobody is DiscussingSee This Report on Summitpath Llp

Most just recently, launched the CAS 2.0 Method Growth Training Program. https://summitpath-llp.jimdosite.com/. The multi-step coaching program consists of: Pre-coaching positioning Interactive team sessions Roundtable discussions Individualized mentoring Action-oriented mini prepares Companies seeking to expand right into advising services can also turn to Thomson Reuters Practice Forward. This market-proven approach provides web content, devices, and advice for firms thinking about advisory solutionsWhile the adjustments have actually opened a number of development possibilities, they have additionally resulted in obstacles and issues that today's companies need to have on their radars., firms must have the ability to rapidly and efficiently conduct tax research and improve tax coverage performances.

Additionally, the brand-new disclosures may bring about a rise in non-GAAP procedures, historically a matter that is highly inspected by the SEC." Accounting professionals have a lot on their plate from regulative modifications, to reimagined organization designs, to an increase in customer assumptions. Keeping speed with all of it can be difficult, however it does not need to be.

Some Known Incorrect Statements About Summitpath Llp

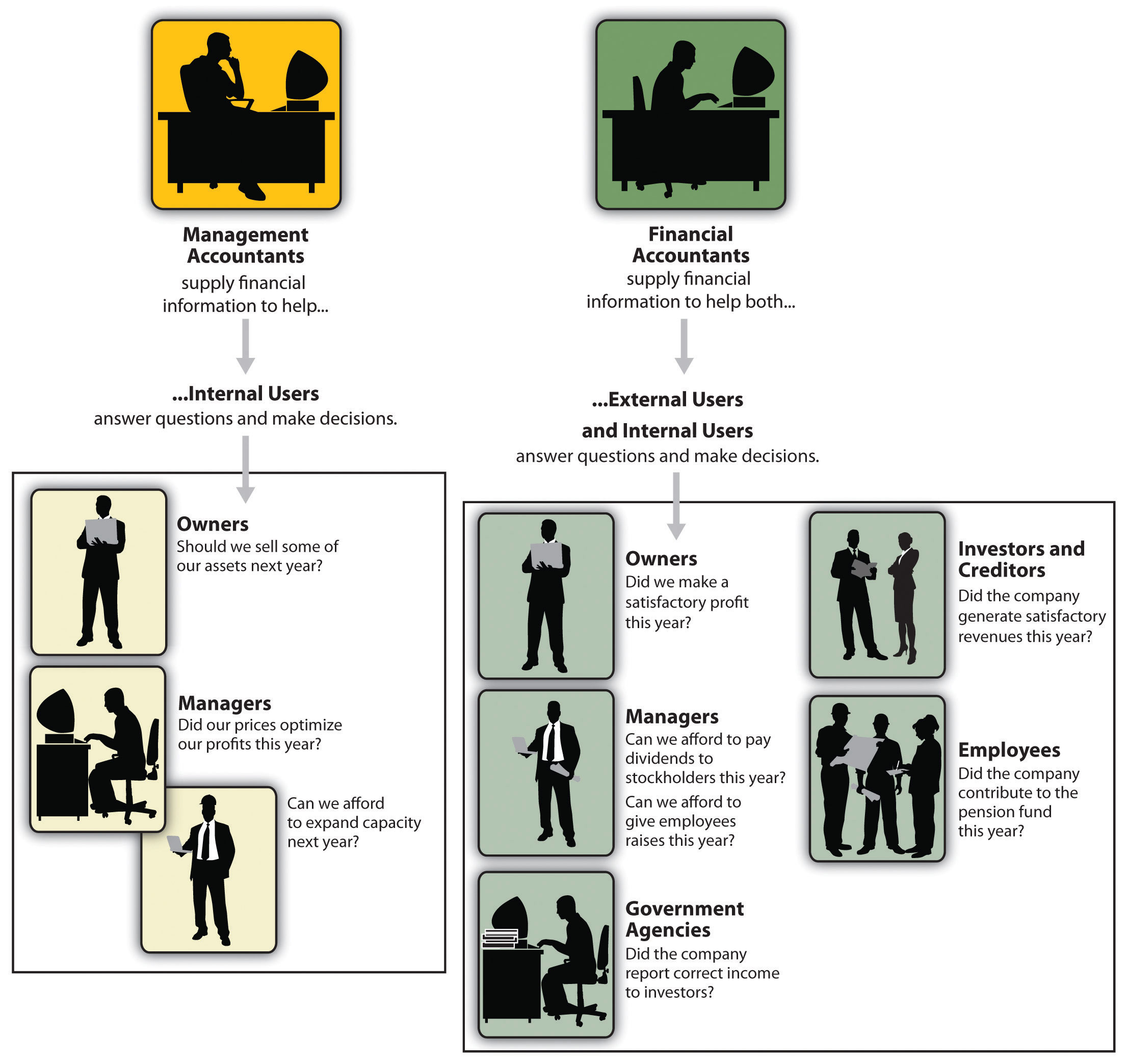

Listed below, we describe four certified public accountant specialties: tax, management bookkeeping, monetary reporting, and forensic bookkeeping. Certified public accountants concentrating on taxes aid their customers prepare and file tax returns, decrease their tax obligation problem, and avoid making blunders that could lead to costly fines. All Certified public accountants require some understanding of tax obligation law, however concentrating on taxation suggests this will certainly be the emphasis of your work.

Forensic accountants typically begin as general accountants and move into forensic accounting roles in time. They need strong logical, investigative, organization, and technological audit skills. Certified public accountants who focus on forensic bookkeeping can sometimes move up into management accountancy. Certified public accountants need a minimum of a bachelor's degree in accountancy or a comparable field, and they have to finish 150 debt hours, consisting of audit and business courses.

No states require a graduate level in accountancy., auditing, and tax.

And I liked that there are great deals of various work choices and that I would certainly not be unemployed after college graduation. Bookkeeping likewise makes functional sense to me; it's not simply theoretical. I like that the debits constantly have to amount to the credits, and the annual report needs to stabilize. The CPA is a vital credential to me, and I still get proceeding education and learning credits yearly to keep up with our state requirements.

The Facts About Summitpath Llp Revealed

As a self-employed expert, I their website still make use of all the standard foundation of audit that I discovered in university, seeking my CPA, and operating in public accounting. Among the important things I truly like concerning accountancy is that there are various tasks available. I chose that I wished to start my occupation in public bookkeeping in order to find out a whole lot in a brief duration of time and be exposed to different types of customers and different locations of accounting.

"There are some offices that don't desire to consider someone for an accountancy role that is not a CPA." Jeanie Gorlovsky-Schepp, CPA A CPA is a very valuable credential, and I wanted to place myself well in the industry for various jobs - Calgary Accountant. I decided in university as an audit major that I wished to attempt to obtain my certified public accountant as quickly as I could

I have actually fulfilled lots of terrific accounting professionals that do not have a CERTIFIED PUBLIC ACCOUNTANT, however in my experience, having the credential actually aids to market your know-how and makes a distinction in your compensation and occupation alternatives. There are some work environments that do not wish to take into consideration a person for an audit role that is not a CPA.

Rumored Buzz on Summitpath Llp

I really enjoyed working on different types of projects with various clients. In 2021, I determined to take the next action in my audit occupation journey, and I am now an independent audit expert and organization expert.

It remains to be a growth location for me. One important top quality in being a successful CPA is really appreciating your customers and their services. I love collaborating with not-for-profit customers for that extremely reason I feel like I'm actually adding to their objective by assisting them have excellent monetary details on which to make clever service decisions.

Report this page